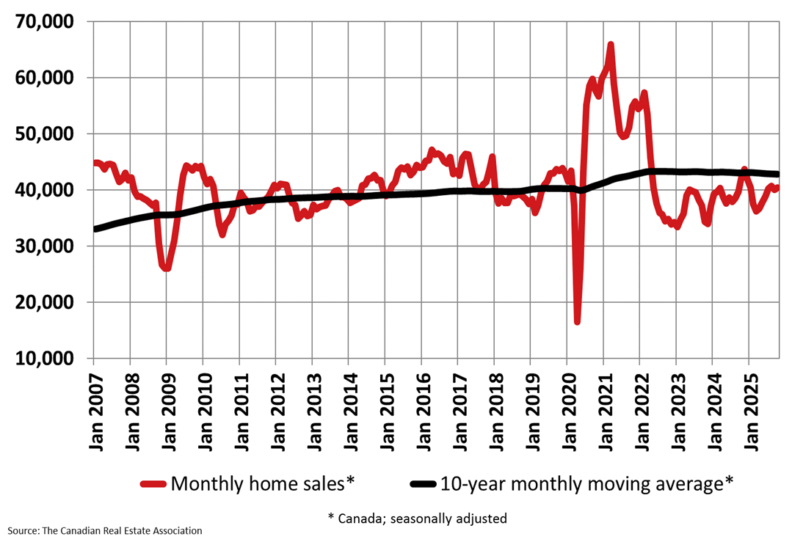

Canada’s housing market is showing renewed signs of life as home sales increased for the sixth time in the last seven months. If you’re watching the Saint John real estate market, these national trends could signal what’s ahead for our region.

According to a new report from the Canadian Real Estate Association (CREA), home sales across the country rose by 0.9% in October compared to the previous month. This slow but steady climb suggests that demand for housing is building momentum.

A National Snapshot: By the Numbers

The latest data paints a picture of a market that is gradually becoming more active. While sales were up month-over-month, they were still 4.3% lower than the same time last year. Here are the key highlights from CREA’s October report:

- The number of newly listed homes for sale actually dropped by 1.4% from September.

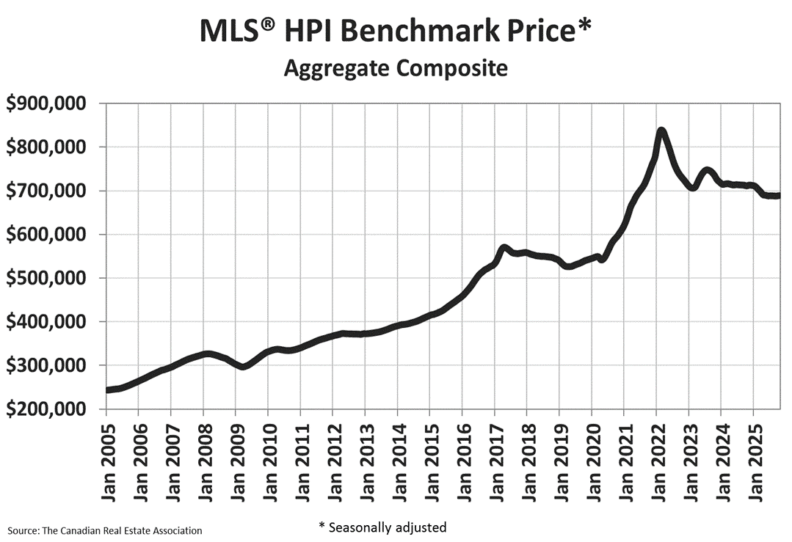

- The national average home price was $690,195, a slight decrease of 1.1% from October of last year.

- The MLS® Home Price Index (HPI), which is a more stable measure of price trends, edged up 0.2% month-over-month but remained down 3% year-over-year.

What the Experts Are Saying

Experts believe lower interest rates are helping to fuel activity, but economic uncertainty is keeping the market in check. “With interest rates now almost in stimulative territory, housing markets are expected to continue to become more active heading into 2026,” said Shaun Cathcart, CREA’s Senior Economist.

The supply of homes for sale remains a key factor. With fewer new listings and more sales, the market is tightening. Nationally, there were 4.4 months of inventory at the end of October. This figure represents how long it would take to sell all available homes at the current sales pace. A market is typically considered balanced when there are between four and six months of inventory.

Valérie Paquin, CREA Chair, noted that pent-up demand could play a big role next year. “All eyes will be on next year’s spring market to see if all that pent-up demand will finally come off the sidelines in a big way,” she said.

What This Means for You in Saint John

While this data is national, it provides important clues for our local market. A tightening supply and rising sales on a national level often precede similar trends locally. If more buyers enter the market this spring as predicted, competition for homes in Saint John could increase.

If you are thinking about buying or selling, these trends suggest that the market is beginning to shift. Understanding the national picture helps you make more informed decisions here at home. For the most accurate advice on your specific situation, connecting with a local real estate professional is your best next step.

Frequently Asked Questions

What is the main takeaway from the latest CREA report?

The main takeaway is that Canadian home sales are gradually increasing, pointing towards a more active housing market in the coming months. This is driven by sustained buyer demand and influenced by current interest rates.

Are house prices going up or down in Canada?

It’s a mixed picture. The national average sale price saw a small year-over-year decrease of 1.1%. However, the MLS® Home Price Index (HPI), a more accurate measure, saw a slight 0.2% increase from the previous month, though it’s still down 3% from a year ago. Prices are stabilizing and showing modest gains in the short term.

How do these national trends affect the Saint John market?

National trends often act as an early indicator for local markets. A rise in national sales and a decrease in new listings could lead to a more competitive market in Saint John, especially as we head into the traditionally busy spring season. It signals that underlying buyer demand is strong.

What is the difference between average price and the MLS® HPI?

The average price is calculated by taking the total dollar value of all homes sold and dividing it by the number of homes sold. It can be skewed by a few very high-priced or low-priced sales. The MLS® Home Price Index (HPI) tracks the price of a ‘typical’ home over time, making it a more reliable tool for understanding true price trends in the market.

0 Comments