Canada’s housing market is shifting into a more stable pattern after a mid-year rally, with both sales and prices seeing slight declines nationally in November. For anyone in Saint John thinking about buying or selling, these trends offer important clues about what to expect in the coming months.

According to a recent report from the Canadian Real Estate Association (CREA), the national market is showing signs of cooling, moving away from the intense conditions seen previously and toward a more balanced state.

A National Look at the Numbers

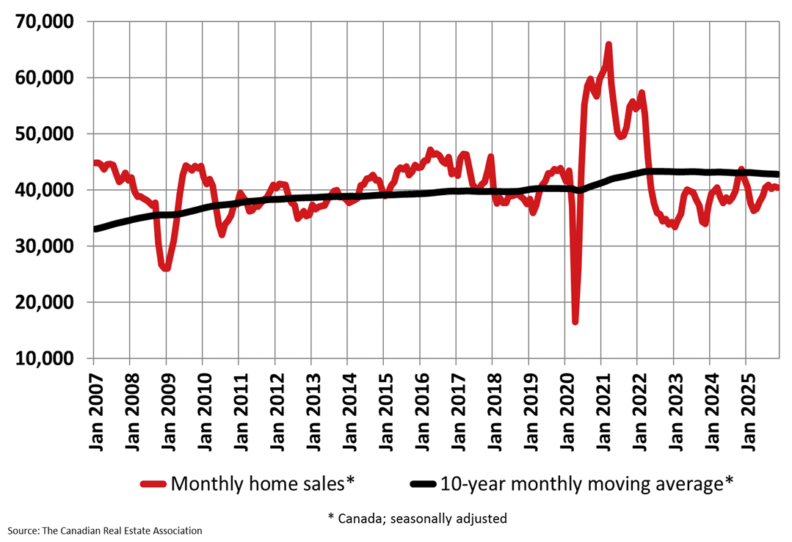

The latest data paints a picture of a market taking a breather. National home sales slipped by 0.6% from October to November, and were down 10.7% compared to the same time last year. At the same time, the number of newly listed properties also fell by 1.6% month-over-month.

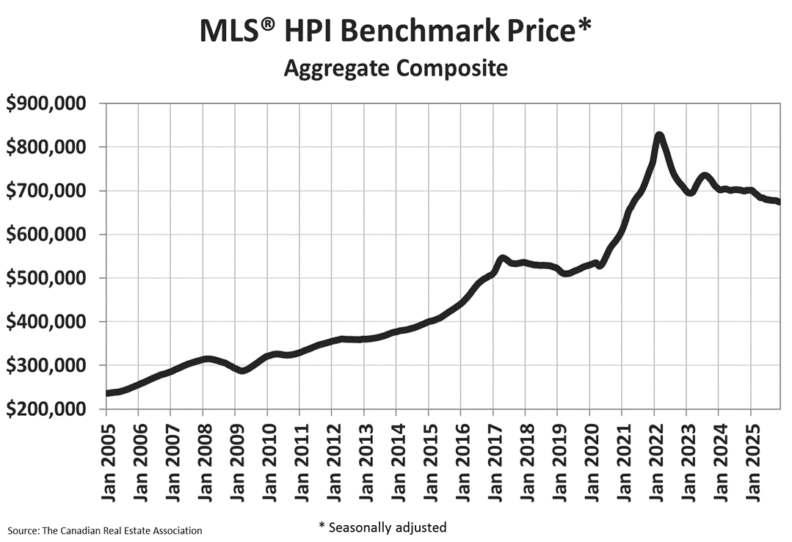

Prices are also adjusting. The national average home price was $682,219 in November, a 2% decrease from the previous year. The MLS® Home Price Index (HPI), which experts consider a more accurate measure of price trends, also dipped by 3.7% year-over-year.

Why is the Market Shifting?

Experts point to a combination of factors driving this change. Shaun Cathcart, CREA’s Senior Economist, described the market as being in a “holding pattern.” He noted that some sellers are making “price concessions in order to get deals done before the end of the year.”

Looking ahead, there is optimism for a more active spring. Cathcart added that the Bank of Canada’s clear signal on interest rates is “the green light many fixed-rate borrowers have no doubt been waiting for.”

This sentiment was shared by CREA Chair Valérie Paquin. “With interest rates now even lower as a result of a softer economy, the focus shifts to the spring of 2026, and whether we’ll finally see the return of more normal levels of housing activity,” she said.

What This Means for You in Saint John

While this data is national, it signals a broader trend that can impact our local market. The key takeaway is balance. Nationally, the sales-to-new-listings ratio sits at 52.7%, and there are 4.4 months of inventory. Both figures suggest that the market is no longer heavily skewed in favor of sellers.

For you as a homebuyer in Saint John, this is welcome news. A balanced market often means less competition, fewer bidding wars, and more power to negotiate on price and conditions. You may find you have more time to make a decision without the pressure of a red-hot market.

If you are planning to sell your home, this shift means that setting the right price is critical. With more balanced conditions, buyers are more selective. A competitively priced home in good condition will still attract strong interest, but the days of expecting multiple, unconditional offers well above asking may be behind us for now.

Frequently Asked Questions

Is this a good time to buy a house in Saint John?

With the national market balancing out, buyers may find more opportunities and face less intense competition. A balanced market often provides more choice and negotiating power. However, local market conditions can vary, so it’s always best to research the specific neighborhoods you’re interested in.

Are Canadian home prices crashing?

The data does not suggest a crash. Instead, it shows a modest year-over-year decline in the national average price. Experts describe this as a stabilization or a market correction rather than a dramatic downturn.

What does “months of inventory” mean?

This metric measures how long it would take to sell all the homes currently for sale at the existing pace of sales. The national figure of 4.4 months is considered a sign of a balanced market, where housing supply and demand are roughly equal.

0 Comments